According to today's NY Times, the Supreme Court has cleared the way for state and local governments to collect taxes on internet sales. While I certainly don't like paying taxes (who does!), this may help level the playing field a bit.

https://www.nytimes.com/2018/0...®ion=top-news

Replies sorted oldest to newest

C W Burfle posted:According to today's NY Times, the Supreme Court has cleared the way for state and local governments to collect taxes on internet sales. While I certainly don't like paying taxes (who does!), this may help level the playing field a bit.

https://www.nytimes.com/2018/0...®ion=top-news

My sentiments exactly, C.W. I shop online both for convenience and enhanced selection. I don't like paying sales taxes either, but local merchants are getting hammered by Amazon and EBay. The unfair advantage is killing retail businesses.

While it may help state's coffers, the biggies like Amazon and Ebay will figure out how to integrate the sales tax into the retail price or shipping while still offering lower prices than most brick-and-mortar stores.

I use Amazon as a last resort for something I can't easily locate locally, so this decision will have little impact on my purchases.

Rusty

Win-Loose : If your local hobby shop has an online presence, or even mailorder, they now have to bookkeep for ALL the states that collect sales tax. After it is accounted for they now have to pay all those states their revenue. That is 45 states - and odds are you will now have to submit a form to all of those states even when you have nothing for them.

One problem solved, 2 new ones created.

"I'm proud to be an American Tax payer - but I could be just as proud for half the money." - Arthur Godfrey

The thing about this new tax system is that OGR or individual sellers will need to start collecting sales tax and remitting it to states for all sales on this forum or other venues like this. This will most likely kill buy/sell sites such as this.

I sell on eBay. I don't see how I can possibly collect and pay sales taxes in all 50 states. I already pay CA sales taxes on all CA sales. eBay will have to do it for me or I will stop selling on the site and other sites like it.

There is more to this than most people think. Every forum internet seller is also going to have this problem if this is true.

NH Joe

Luckily, as most of what l buy on line is old and used, this will have little effect. My first thought about helping local business, was "What local hobby shop?"; My second was, "Which of the five? states that don't collect sales tax is the closest?" Related to the first question is the problem that the local stores stock nothing you need, so obviously don't want your business, and you have to go far afield to get what you want.

I don’t think the casual sell on this or other forums will be affected much. However if you are actively selling thousands of dollars worth of merchandise it will certainly be an issue.

I already pay sales tax on most items from Amazon and other sites unless the products are coming from a third party.

I don't see how it will help local hobby shops at all. It will help state govs generate more, much needed revenue and not much else. The reason I buy most of my stuff on-line isn't tax avoidance but to find the things that I want and sometimes at a better price, regardless of the tax burden. I don't have a problem with paying taxes on internet purchases. I pay them on some sites already. My state as required payment of on-line purchases for years. The burden has been placed on the consumer to remit payment to the state.

We don't have a local hobby shop and haven't for years. This will put a lot of people out of business. Think of how much it will cost people to remit sales tax to all these states.

It begs the question, how will it be enforced? If I sell in my state I have to get a state sales tax ID number to sell in my state. Then fill out forms monthly, quarterly or yearly depending on sales. Will every business have to get their own tax ID number for every state? Will states have the ability to monitor credit card transactions? Talk about a can of worms.

Pete

All in all, I think this is a fair ruling. Hopefully, it will help local merchants better compete with on-line sellers while also restoring a lot of lost tax revenue to the states.

The ruling won't dissuade me from buying online. I never have, and did not start buying online because of any tax savings.

Also, a lot of places with which I do business already collect tax from me, including Amazon, and some online music retailers.

Norton posted:It begs the question, how will it be enforced? If I sell in my state I have to get a state sales tax ID number to sell in my state. Then fill out forms monthly, quarterly or yearly depending on sales. Will every business have to get their own tax ID number for every state? Will states have the ability to monitor credit card transactions? Talk about a can of worms.

Pete

Nothing is ever as bad as we fear, or as good as we hope for. If you are incorporated, then you should already have an EIN. If you sell as an individual, your SSN is your tax ID number.

With collecting sales taxes I suspect that the states will put floors on the amount of sales before you have to start remitting sales taxes to the state, and that rule would likey not apply to private sellers on a place like ebay (my guess FWIW is seeing an opportunity in this, Ebay will offer a service allowing them to calculate and collect sales tax for sellers). The actual calculating taxes is not a big deal, there are applications out there that let you put in a zip code and calculate them, the big one is going to be the bs around registering with a state as someone who sells to people in those states, that is the pain.

I suspect it may not happen as fast as the states wish. For example, they could file suit if a state has this cumbersome, expensive process to file for a tax ID, they could (IMO, not a lawyer) argue that is restraint of trade, that their method for example favors people in the home state.

My real hope is that congress wakes up and steps into this, the only reason the Supreme Court is involved is that congress has not stepped in. Congress has the authority under the interstate commerce clause, and they could, for example, rule that states have to create a central clearinghouse for businesses so that those businesses don't have to go through dealing with 45 individual states, they could also exempt businesses below a certain size from needing to file taxes, or they could write the law that once exempts internet purchases except if they have a presence in that state. The court decision simply said requiring out of state sellers to collect and remit sales taxes is not unconstitutional, it doesn't mean that protecting such sales, or regulating them, is unconstitutional, congress has that role clearly defined (it would be one of the few cases in recent years IMO that actually uses the interstate commerce clause for its original intention!). Congress has ducked this issue for a long time, and it is time IMO they get involved.

I suspect in practical reality that most states will only go after big players, the Amazons, Walmarts, sites like Wayfair and Overstock, places that do a lot of business, and will either exempt or ignore small businesses.

1. I buy on ebay for items my two LHS do not have, or ordered ! I pay taxes one way or another.

2 if you sell on ebay . I was told ebay or Paypal handles the taxes ! I believe you have to sell more than $600 to make a difference if you are not a store . Stores have to collect the taxes ! Not the Buyers !

3 when all the tariffs are in place , most of us will slow or stop buying trains !

4 my train buying days have come to a very slow pace ! I have only pre-ordered three items this year ! next year will be the same or lower ! I have enough Engines in O or HO ! same for Freight cars !

For those of you that do not have a LHS , I feel sorry for you ! Try to find a Hobby shop that ships to your state !

In Illinois all fleamarket and show hosts report the contact info of all vendors to the state. Illinois expects a completed sales tax form and a check from each vendor for sales tax collected at each event. Some townships in Illinois charge a flat rate local tax of $25 or more just to have a garage sale. Please do not identify yourself in this forum as someone who ignores Illinois sales tax requirements. The fine is $650 and no statute of limitation.

Most if not all fleamarket and garage sale sales are of used items which were already taxed once when bought new by the original owner.

The state's position is sellers are competing with local brick and mortar businesses. (Even used baby clothes)

Point is:

Don't kid yourself with any extra revenue this law creates, the state will have the $resources to enact more laws for more. Revenue and enforcement.

(Theres a hand in your pocket that wants all your loose nickles)

1 - I have no LHS, nor do most of us. So, no relevance.

2 - States should get sales taxes from internet purchases. That they don't can't be justified. But - they better be clearly going to my state.

3 - Most of my hobby purchases are on eBay, many from brick-and-mortar shops, I imagine, so they are already "getting my business".

Taxes: 1/2 of the equation of things unavoidable.

Rusty

Ok, you are right about "new" purchases. But how will you like paying your state say..8% sales tax on that "used" "new in the box. Unopened "

engine you already paid tax on when new. A $1000 sale at say 8% is $80 you gift to that state

I am fully in favor of sales tax set by state referendum and voted into law.

I am fully supportive of existing state sales tax law.

I am cautious that this ruling could be abusive.

Say what you will about the benefit to brick and mortar, have no sympathy for resellers needing to keep records and file with each state,

....in the end..you pay the tax

Here in NY businesses, including those who only sell occasionally af flea markets / train shows are required to have sales tax numbers and collect tax on all merchandise, new and used.

I buy online because my LHS dose not have what I need. So taxing me on an item that they don't carry isn't helping any brick and mortar store. The tax is simply to allow the states to consume more taxpayer monies.

C W Burfle posted:Here in NY businesses, including those who only sell occasionally af flea markets / train shows are required to have sales tax numbers and collect tax on all merchandise, new and used.

Yes, but the tax goes to NY not some other state.

Most internet sales that I make are out of state. This is where tax filing will hurt. I am sure that my state, CA, will be very aggressive about collecting sales taxes from out of state retailers who sell to CA residents. Do NY sellers want to get a CA tax number and file in this state? I don't want to get a NY tax number and file every year because I sell a $50 item to a NY resident via the internet.

There is almost no possibility that Congress will do anything about this. Congress always ducks hard issues.

NH Joe

BMT-Express posted:Win-Loose : If your local hobby shop has an online presence, or even mailorder, they now have to bookkeep for ALL the states that collect sales tax. After it is accounted for they now have to pay all those states their revenue. That is 45 states - and odds are you will now have to submit a form to all of those states even when you have nothing for them.

One problem solved, 2 new ones created.

"I'm proud to be an American Tax payer - but I could be just as proud for half the money." - Arthur Godfrey

Not exactly. If the local hobby shop has a retail presence they already collect state taxes and so collecting taxes on internet sales isn't reinventing the wheel or doing anything new.

The misconception I'm seeing here is that the taxes have to be paid into the states in which the sale has been made and that is completely and unequivocally not true. The taxes are paid into the state in which the sale has been made - if the store is in NY, the person making the purchase pays the local sales tax for the area in which the business is located.

This, in fact, causes a bigger problem for the Amazon's and large web retailers of the like. Large retailers like Amazon have regional distribution hubs and/or warehouses from which they ship their product. The local taxes are paid to the state/region in which the warehouse is located and the product ships from, not the home state for the retailer's headquarters.

The benefit to the local stores that's attempting to be promoted in this topic is that, with the buyer no longer having the advantage of not paying taxes on their out of state purchases and now, in some cases having to pay higher taxes than in their local region (pretty sure the VAT in NY is higher than mine) and then having to pay shipping in addition, it truly does save money to shop at your local brick and mortar than it does to shop online. The advantages to online shopping will fall to volume discounts and ease of operation rather than final cost.

Personally, being someone who works for a locally owned and operated business, I prefer to support local business as well whenever possible. At the very least, there's no coming home to find my expensive online purchases have fallen victim to a porch pirate. Additionally, when I need that same local business to help me with repairs or answers to technical questions they're more likely to still be in business.

Just my $.02 with a little factual information thrown in.

Most internet sales that I make are out of state. This is where tax filing will hurt. I am sure that my state, CA, will be very aggressive about collecting sales taxes from out of state retailers who sell to CA residents. Do NY sellers want to get a CA tax number and file in this state? I don't want to get a NY tax number and file every year because I sell a $50 item to a NY resident via the internet.

Me get a CA tax number? Certainly not. In fact I am probably going to get rid of my NY tax number and give up doing shows. The money I take in just is not worth the hassel.

Maybe EBay or Paypal will collect and submit taxes as part of their service.

D500 posted:1 - I have no LHS, nor do most of us. So, no relevance.

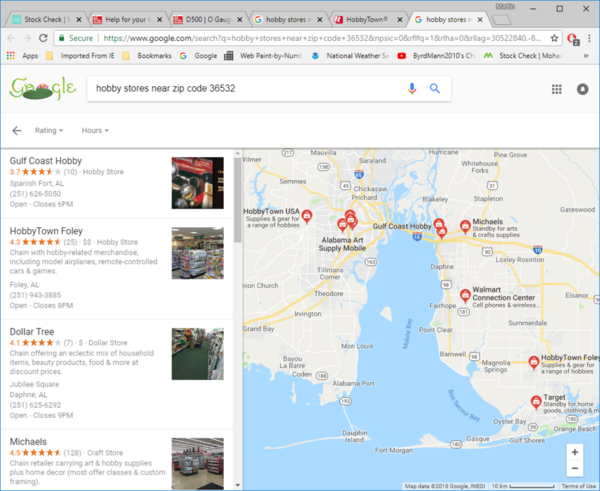

Based on the zip code in your profile, I did a google search for "hobby stores near ..." see results below:

Not intending to start something. Just making the point that only the most rural of us don't have close access (you can add your own definition of close) to something. For me, it's an hour drive but within only a few minutes of work.

Attachments

BMT-Express posted:One problem solved, 2 200 new ones created.

Gov't in action. 200 more reasons not to support any tax increase ever.

Unfortunately, governments need money to operate and provide services. We all use government services.

C W Burfle posted:Unfortunately, governments need money to operate and provide services. We all use government services.

Especially this folks who don't work!

With any luck this will be the beginning of the end of sales taxes for everything but luxury goods (say over $1,000). Sales taxes are regressive and hurt the poor, working class and lower middle class most in almost all cases. Sales taxes often apply to food, clothes and other necessities (diapers, toy trains, etc. ![]() ). A simple, national, mildly progressive income tax on everyone (above a certain base level of income), proportionally returned to the individual states, no deductions whatever, filed on a postcard as in some Baltic states, would lead to many of us doing more productive work. It would avoid creating protected classes of taxpayers (e.g., homeowners), and monstrously large and wasteful bureaucracies that produce absolutely nothing of concrete value to society (the IRS, tax professionals--sorry folks). Could be phased in gradually over a decade or two if we had the will, to avoid causing unemployment and economic disruption. Probably won't happen, but worth thinking about.

). A simple, national, mildly progressive income tax on everyone (above a certain base level of income), proportionally returned to the individual states, no deductions whatever, filed on a postcard as in some Baltic states, would lead to many of us doing more productive work. It would avoid creating protected classes of taxpayers (e.g., homeowners), and monstrously large and wasteful bureaucracies that produce absolutely nothing of concrete value to society (the IRS, tax professionals--sorry folks). Could be phased in gradually over a decade or two if we had the will, to avoid causing unemployment and economic disruption. Probably won't happen, but worth thinking about.

Now I've done it, probably will be banned from the forum ![]() .

.

I do not know about the rest of you but, every State that I have lived in for the past five decades Have required that when filing you state income taxes you account for/settle up for sales taxes of out of your own state purchases.

Also state tax codes most probably address certain sales where collecting sales taxes in NOT necessary. As an example the codes here in NC, I do NOT have to collect sales tax on my own personal items I sell at train shows since am not actually a dealer.

Ron

Local sales tax avoidance may have been a motivating factor early in the internet sales arena.

But today, sales tax and the competitive pricing are what most sales are about. Internet sellers sell more, purchase stock at volume discounts and their profit margins are higher because of it. They also benefit from discounted shipping costs. They are open 24/7. Local brick and mortar sales will still be poor. This only benefits state revenue. The state is not going to help subsidise brick and mortar.

States are losing revenue to internet sales because companies choose not to build brick and mortar warehouses or distribution centers in those states. Perhaps states with falling revenues need to look in their own backyard for why their businesses are failing ( no sales tax if no businesses to sell and generate it) and certainly no revenue if the state economy is in decline. While some states may see this as a cash cow, time will tell whether their residents really are buying anything on line.

In my opinion, there is only one way to do this. The tax is collected and paid to the SELLER'S state, not the buyer's state. Then there's no dealing with 44 other state's taxes.

It would be as if I walked into Charlie Ro's in Massachusetts and bought trains directly over the counter. Instead he ships them to me, so I pay that too. Minnesota doesn't deserve a penny of that sale.

Someone from Colorado buys something from Minnesota they pay Minnesota tax. This more correctly reflects the state's retail sales.

Byrdie posted:The misconception I'm seeing here is that the taxes have to be paid into the states in which the sale has been made and that is completely and unequivocally not true. The taxes are paid into the state in which the sale has been made - if the store is in NY, the person making the purchase pays the local sales tax for the area in which the business is located.

Just my $.02 with a little factual information thrown in.

If this is true than many of the states will be losing rather than gaining funds. Sales on items bought from out of state vendors are now reported on New York State Income tax. You have three choices. Collect your sales slips for proof on audit, calculate the tax and add it to your state income tax, or just pay an additional tax based on a percentage of your income, or claim no purchases from out of state. The last option could trigger an audit.

If you already paid a sales tax to another state then New York can not claim sales tax. As a result since most states have a lower sales tax than New York it could still be beneficial to buy out of state and New York would get less revenue rather than more.

Pete

I hav been buying online for many years and this will not stop me. I have also been selling online and if I have to pay taxes then the time has come to end my little business.

The states along with the federal govt. need to control their spending not to keep adding taxes.

Dave

Landsteiner posted:With any luck this will be the beginning of the end of sales taxes for everything but luxury goods (say over $1,000). Sales taxes are regressive and hurt the poor, working class and lower middle class most in almost all cases. Sales taxes often apply to food, clothes and other necessities (diapers, toy trains, etc.

). A simple, national, mildly progressive income tax on everyone (above a certain base level of income), proportionally returned to the individual states, no deductions whatever, filed on a postcard as in some Baltic states, would lead to many of us doing more productive work. It would avoid creating protected classes of taxpayers (e.g., homeowners), and monstrously large and wasteful bureaucracies that produce absolutely nothing of concrete value to society (the IRS, tax professionals--sorry folks). Could be phased in gradually over a decade or two if we had the will, to avoid causing unemployment and economic disruption. Probably won't happen, but worth thinking about.

Now I've done it, probably will be banned from the forum

.

I suspect the banning party is being formed in Ohio as I write. ![]()

First, all toy train sales should be tax free. Why not?

Second, dump the income tax and institute (as Landsteiner says) a VAT that acts as a brake on consumption and encourages saving and other good things. Time to do ... but there is no political will to make anything rational happen.

Having an Amazon distribution center here and seldom buying online elsewhere, I already pay tax, so this won't affect me much. And more importantly, it won't change my decision to buy online. I get more value added from the reviews than I do from local retailers, so why should I reward them for shoddy service? Shopping at my LHS is a very poor experience. Not only is it a 45 minute drive, but the store is super small and junkie. I'd be in real trouble if I lived near Mr Muffin's. ![]()

I'll join the club. The one full of members saying that this new development won't change their buying habits much, if at all. Most of my train buying is online and will remain so into the future.

rthomps posted:Second, dump the income tax and institute (as Landsteiner says) a VAT that acts as a brake on consumption and encourages saving and other good things. Time to do ... but there is no political will to make anything rational happen.

Quick research shows VAT in Europe runs between 20%-25%, depending on country.

Are you ready to pay that much more for goods and services? Especially if based on list price vs. discount price? (I don't know if it is or isn't.)

Rusty

Rusty Traque posted:rthomps posted:Second, dump the income tax and institute (as Landsteiner says) a VAT that acts as a brake on consumption and encourages saving and other good things. Time to do ... but there is no political will to make anything rational happen.

Quick research shows VAT in Europe runs between 20%-25%, depending on country.

Are you ready to pay that much more for goods and services? Especially if based on list price vs. discount price? (I don't know if it is or isn't.)

Rusty

It's complicated - and takes much more discussion than we can do on the OGR site. (We can, however, maintain our claim that toy trains are never to be taxed!

![]()

There would be (presumably - HA! HA!) a reduction in income taxes. Complicated as I said. It isn't going to happen anyway anytime soon. ![]()